Key person life insurance is designed to protect a business against potential financial loss caused by the death of an employee who is critical to the success and profitability of the business. The business is the owner and beneficiary of the policy.

Who Is a Key Employee?

A key employee is anyone who contributes significantly to the financial success of the business. A key employee (who may or may not be an owner) is anyone who is responsible for management decisions, is highly paid, has a significant impact on sales, or has a special rapport with customers or creditors.

Why Is Key Employee Life Insurance Needed?

A business can suffer from a key employee’s death in a number of specific ways. One is the loss of

the person’s management skill and experience, especially in a business with little management depth. Another is the disruption of business when clients withhold or delay business dealings until the impact of the employee’s death becomes known. Credit difficulties can arise, since creditors often remain cautious until they can assess how the key person’s death will affect the business. Finally, increased expenses inevitably accompany the hiring and training of a key employee’s replacement.

How Does It Work?

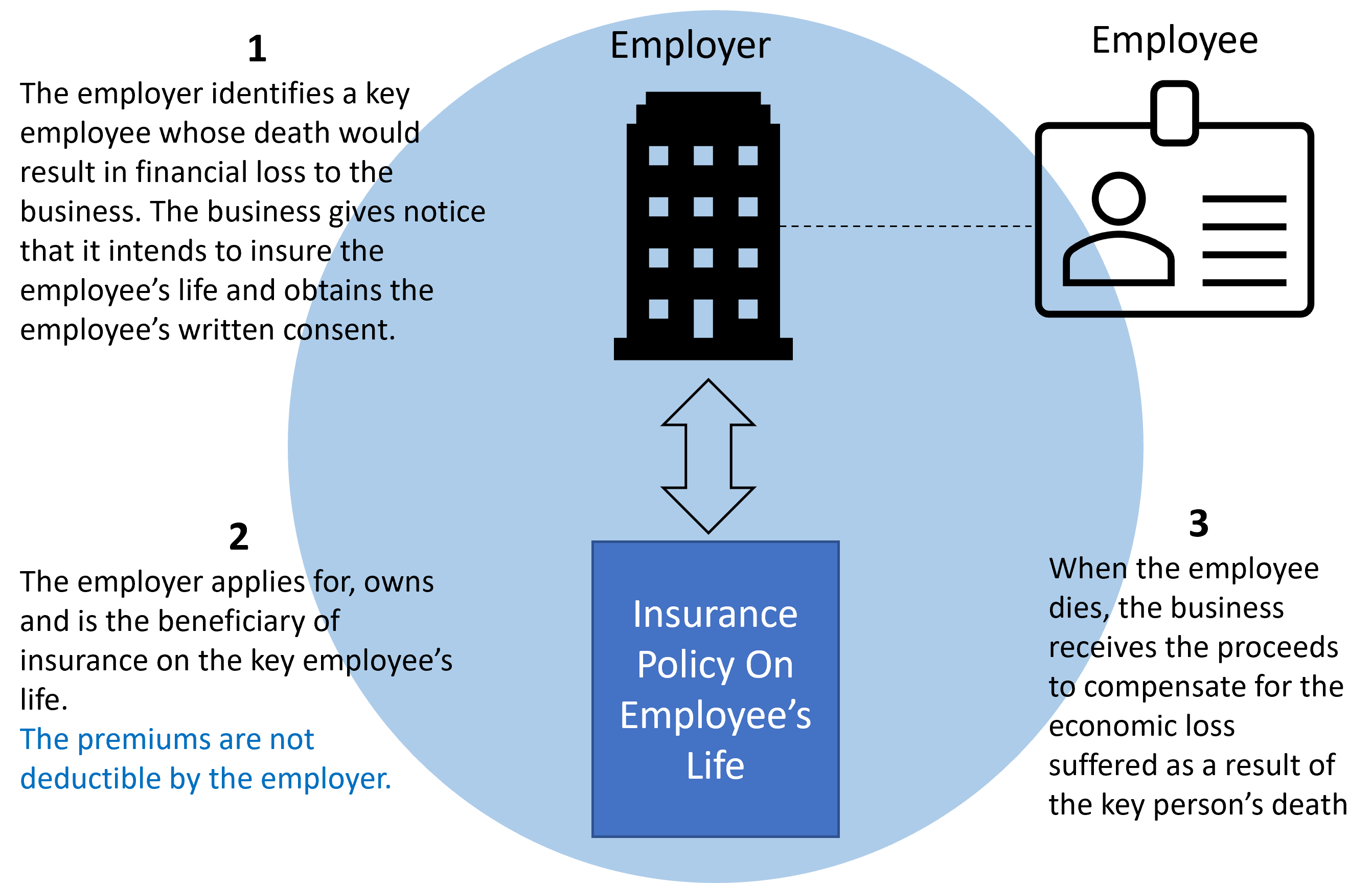

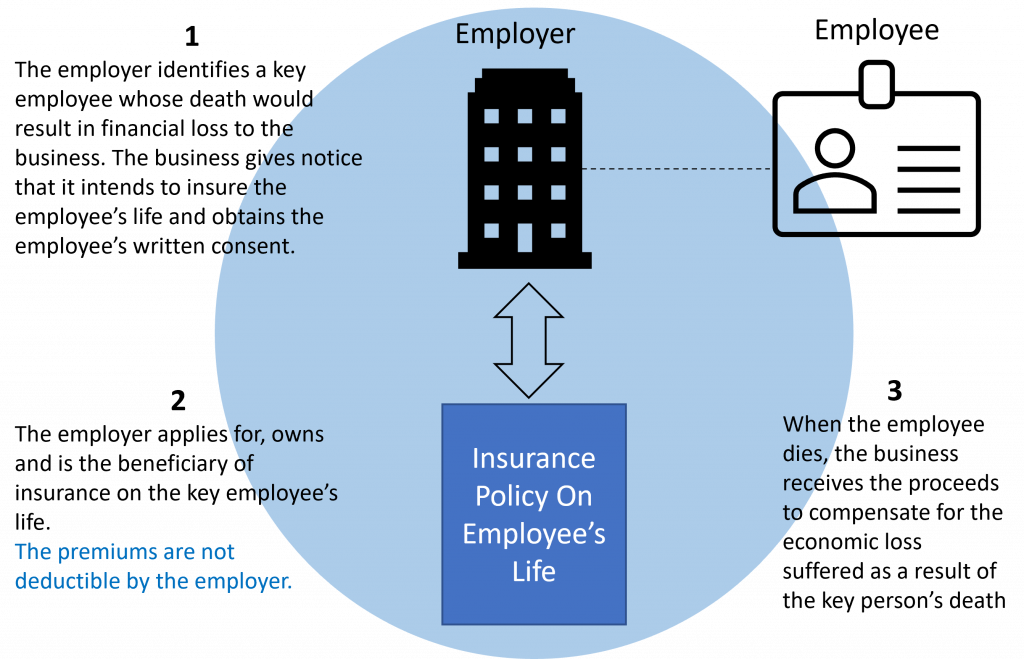

The business applies for and is the owner and beneficiary of the life insurance policy. If the insured employee dies, the business receives the policy proceeds. Premiums are not deductible, and death proceeds are usually not subject to federal income tax.

Because the business holds all incidents of ownership in the policy, the death proceeds are not included in the insured employee’s estate for federal estate tax purposes unless the employee is a sole or controlling shareholder. In this situation, a corporation’s incidents of ownership are attributed to the shareholder-employee.

NOTE: In order to receive the insurance proceeds free of federal income tax, the business must comply with the notice and consent requirements. This includes notifying the employee in writing of the intention to insure the employee’s life for a stated maximum amount, obtaining the employee’s written consent to being insured under the policy, and informing the employee in writing that the business itself will be a beneficiary of any proceeds, either directly or indirectly.

What Are the Benefits?

Key person life insurance serves a number of uses benefiting a business, both during the key employee’s life and after the employee’s death. Death proceeds are generally exempt from federal income tax when the notice and consent requirements have been met.

NOTE: Depending upon the type of policy features, if the employee is diagnosed with a critical illness such as heart-attack, cancer, stroke, terminal or chronic illness and is unable to go back to work, a portion of the death benefit proceeds can be accelerated depending upon the severity, while the employee is still living. The accelerated death benefit proceeds can be used by the employer to train and hire another employee or as deemed necessary. Contact us to structure a key person life insurance plan that can provide these living benefits.

If the insured employee doesn’t die while employed, the policy’s cash value is available to the business. Key person life insurance demonstrates financial stability to creditors. If the key employee is an owner of the business, the policy can help fund a buy-out of a business interest when death occurs. If the employee lives, the policy’s cash value can be used to provide employee compensation.

Are you working with a financial professional? Contact us to structure a Key Person Life Insurance for your key employees.