In the vast realm of personal finance, achieving financial freedom remains a universal aspiration. Yet, the pathway to this goal is often obscured by overwhelming information and advice. To simplify and streamline, we’ve broken down the journey into six essential pillars. By mastering these, you’re setting the foundation for a thriving financial future.

- Budget and Live Frugally:

- Master Your Money: Begin by having a clear picture of where your money comes from and where it goes. Regularly track and review your income and expenses.

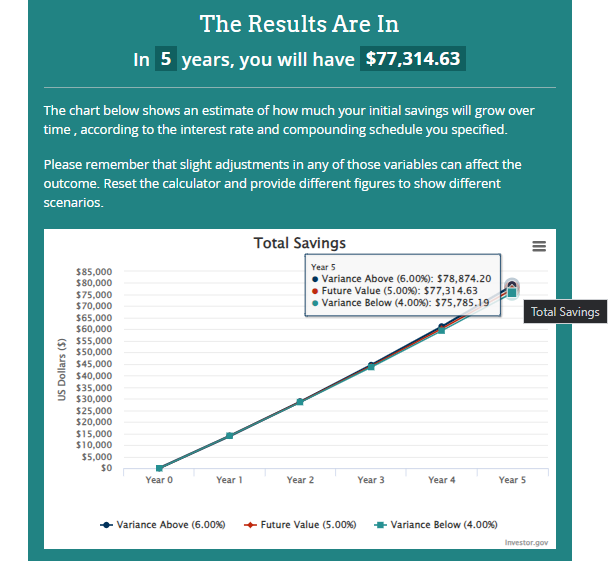

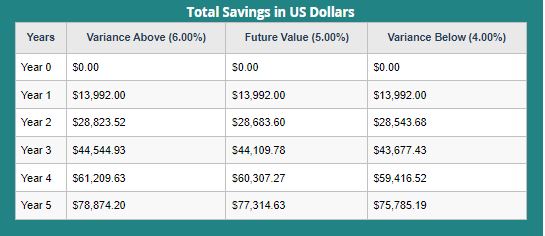

- The Power of Frugality: Embracing a frugal lifestyle doesn’t equate to a life of deprivation. Let’s dive into the numbers for perspective: If you’re earning $70K annually and manage to save 20% each year, by the end of five years, you’d have essentially banked a year’s salary. Now, the magic happens when you invest this strategically. Say you choose an account compounding at a modest 5% annually, where you’re guaranteed never to lose your principal, have tax-advantaged gains, and maintain liquidity without the penalties often associated with traditional accounts like 401(k)s. Over time, your savings not only preserve their value but also grow (see image below). This disciplined, strategic approach is paramount in your journey to financial freedom and is often the unsung hero behind many success stories. Use the free calculator here to test various scenarios: https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

- Save and Prepare for Emergencies:

- Consistent Savings: Regardless of how much you earn, aim to save 10-20% of your income. Consistency is key.

- Emergency Readiness: Life’s unpredictable. An emergency fund covering 3-6 months of expenses ensures you’re prepared for unexpected financial hiccups without diving into debt.

- Manage Debt and Limit Liabilities:

- Debt Discipline: High-interest debt can cripple your financial growth. Prioritize its elimination and be wary of accumulating new debts without a clear repayment plan.

- Invest Strategically:

- Early Bird Advantage: Start investing as soon as you can. Thanks to the power of compound interest, even modest initial investments can flourish over time, setting the foundation for a prosperous future.

- Diversify Your Portfolio: While many are familiar with stocks, bonds, and real estate, an often-overlooked asset class is cash value life insurance. Many affluent individuals have not only recognized its merits but have effectively leveraged it. Beyond the death benefit, these policies, like Indexed Universal Life (IUL) insurance, offer an investment component. Unlike other investment vehicles, they have no binding minimum contributions, and under IRS Code 7702, the accumulated cash value can be accessed without the penalties associated with many other investments. This makes them a favored strategy among those in the know.

- The IUL Advantage in Retirement: When crafting a comprehensive retirement strategy, consider integrating Indexed Universal Life insurance. Beyond its protective death benefit, an IUL provides a cash value that can grow tax-free, linked to a stock market index. This allows for potential appreciation during market booms, coupled with protection against downturns. When retirement dawns, this cash value can serve as a supplemental income source, without the stringent withdrawal restrictions or obligatory distribution ages typical of traditional retirement accounts. This combination of growth and flexibility makes IULs a prime component of a balanced retirement blueprint.

- Increase and Optimize Income:

- Multiple Revenue Streams: While your primary job might be your main income source, side gigs or freelance opportunities can act as financial cushions and accelerate savings.

- Review to Renew: Financial goals aren’t set in stone. As market conditions and personal situations evolve, regularly review and adjust your strategies.

- Stay Informed and Learn:

- Lifelong Learning: The financial world is ever-evolving. Commit to ongoing education, whether through books, seminars, or consultations with experts.